Dive Brief:

- Over 80% of survey respondents who experienced a free trial or existing subscription said they would definitely or probably buy subscription-based services for a future vehicle, an S&P Global Mobility survey found Wednesday.

- Another 85% of respondents who had previously subscribed to a service said they would recommend it to a friend.

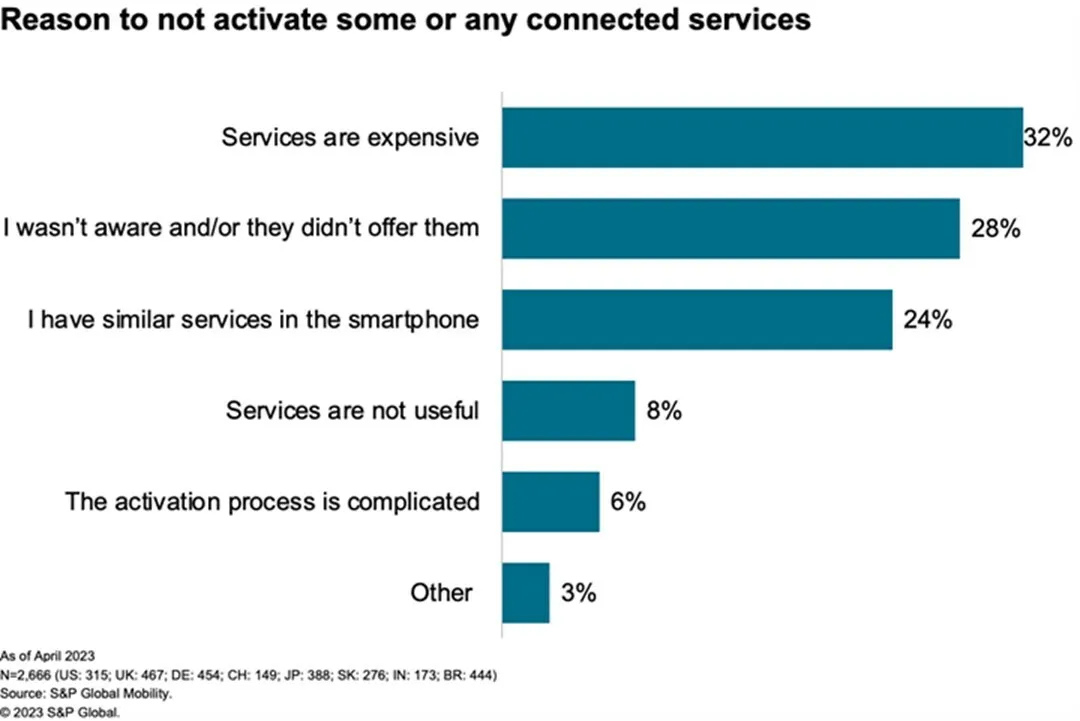

- But 28% of respondents said they didn’t know connected services were available or that the dealer did not offer or mention them. Improving point-of-sale education is crucial to growing connected-car subscriptions, S&P Global said.

Dive Insight:

BMW, General Motors and other automakers have spurred consumer backlash after announcing that they would charge subscription fees for features like heated seats and onboard infotainment in future vehicles — sometimes eliminating popular features like Apple CarPlay and Android Auto in the process.

But car shoppers are more willing to buy subscriptions if they add value, the survey found. For instance, nearly 9 in 10 survey respondents were satisfied with paid safety upgrades like high-beam assist and driving video recording. Consumers are also willing to pay for navigation and security features.

Car shoppers are most willing to pay for features they use regularly.

"The frequency of usage is an important factor," Yanina Mills, senior technical research analyst at S&P Global Mobility, said in a statement. "If you have a feature that you only use once or twice, you're not going to renew that feature." Using heated seats or a heated steering wheel is very climate-dependent, so usage can vary by season.

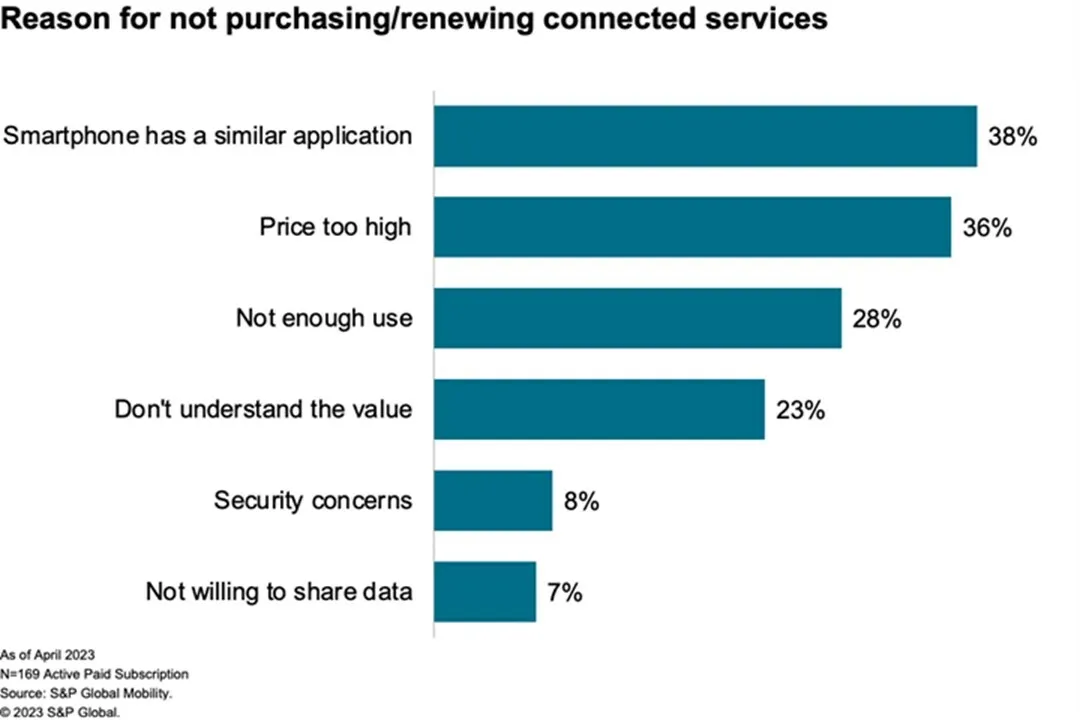

They are also less likely to pay for services built into their smartphones. But eliminating features like Apple CarPlay and Android Auto probably won’t make consumers much more likely to buy subscriptions since 89% of people renew their subscriptions.

Owning consumer data is a more compelling reason for automakers to curb access to third-party apps.

"GM cannot get consumers' usage data from the infotainment system if users only connect via third party apps like Apple CarPlay and Android Auto," Fanni Li, connected car services research lead at S&P Global Mobility, said in a statement. "Having this data on their own will become one of the competitive advantages for OEMs."

But consumers remain wary of handing over their data, with 37% of survey respondents worrying about security.

“Turns out the best way to win over consumers is to give them something for free,” S&P Global Mobility said. Nearly 3 in 4 respondents would share data for free services.

S&P Global Mobility surveyed almost 8,000 consumers for the study.