Dive Brief:

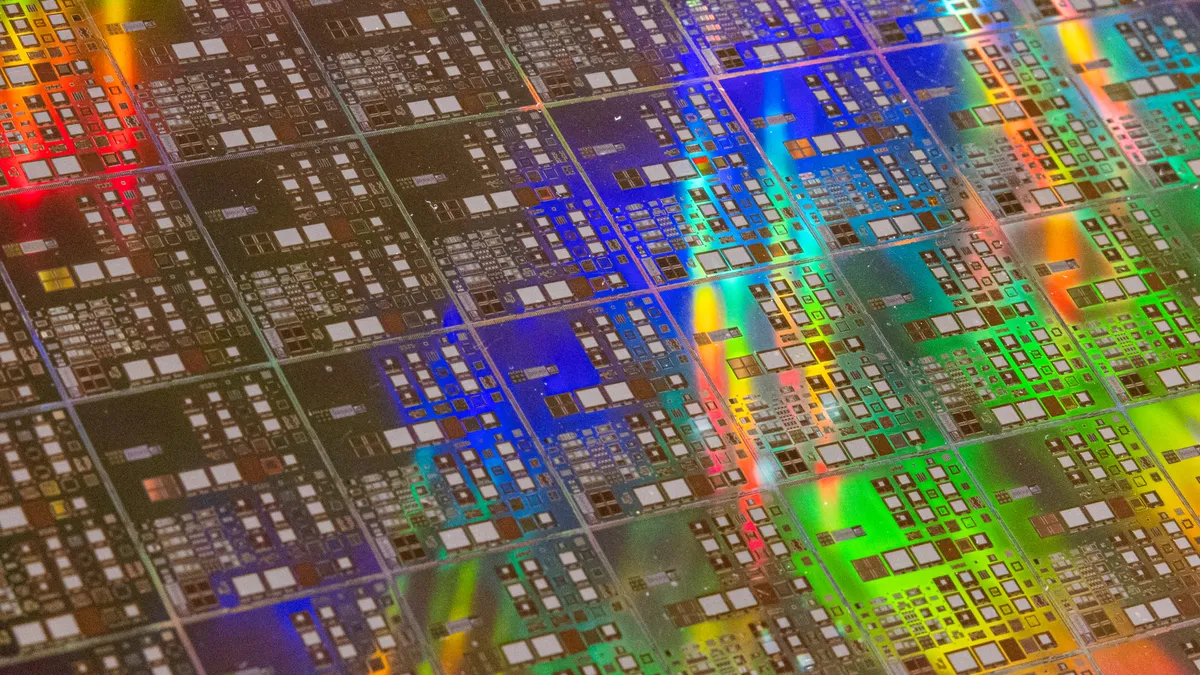

- Stellantis is implementing a new strategy to secure a reliable and long-term supply of semiconductors required for future vehicle platforms, the automaker announced in a press release.

- The automaker said it is already engaging with strategic semiconductor suppliers, including Qualcomm, Infineon and NXP Semiconductors.

- As Stellantis prepares to launch four new electric vehicle platforms, a larger number of semiconductors will be needed to support a wide variety of advanced vehicle functions, including connectivity, infotainment, safety systems and autonomous driving.

Dive Insight:

Stellantis’ new semiconductor strategy includes risk assessment, purchasing critical parts from chipmakers and securing long-term chip supply deals. Stellantis also plans to implement a database of semiconductor content and enforce a green list to reduce chip diversity, which would provide the company with better control of chip allocation in case of a future shortage.

Although the auto industry has largely recovered from the semiconductor shortages of the past two years, as the world’s makers electrify their model lineups, demand for more advanced semiconductors is expected to increase, according to S&P Global.

The automaker’s new vehicle architectures will require a reliable supply of advanced chips to support its plans to have more than 75 battery-electric models for sale by 2030 and achieve annual sales of 5 million vehicles in the same time frame.

“An effective semiconductor strategy requires a deep understanding of semiconductors and the semiconductor industry,” Maxime Picat, chief purchasing and supply chain officer at Stellantis, said in a statement. “We have hundreds of very different semiconductors in our cars.”

Stellantis is already working with autonomous driving technology developer aiMotive and chipmaker SiliconAuto to develop its own semiconductors. SiliconAuto is the new joint venture of Stellantis and Foxconn. The company is developing custom chips to support the automaker’s next-generation electric vehicle platforms starting in 2026. This includes the automaker’s new electrical/electronic and software architecture that support over-the-air software updates.

To date, Stellantis said it has entered into supply agreements for semiconductors with a purchasing value of more than $11.2 million (10 billion euros) through 2030. These agreements include Silicon Carbide MOSFETS for EVs, microcontroller units and system-on-a-chips that support high-performance computing units, such as those used to support autonomous driving.

“SiC MOSFETS extend the range of our electric vehicles while the computation performance of a leading-edge SoC is essential for the customer experience and safety,” Picat said in a statement.

Stellantis recently unveiled its STLA Medium electric vehicle platform after over two years of development. It will serve as the foundation for up to 2 million battery-powered vehicles a year, according to the automaker.